Year

2017

Methodologies

- Strategic design

- User Experience Design

Deliverables

- Future vision

- Platform strategy

- Prototype app

Banks increasingly see the value in working together with fintech instead of fighting them.

For many years banks have played an important role in society by providing security and facilitating trade. However, just as many other industries, banks are not safe from the disruption that the internet brought us. At a certain moment in time, banks started to realise that fintechs were slowly eating away the foundations on which they are built. And instead of fighting them, banks increasingly start to realise they need to take their business models into the 21st century by looking at fintechs as partners.

You can’t simply build a platform,

it needs to be grown, to be nurtured,

with carefully orchestrated interactions

This project revolved around the question: How can a traditional global bank become a platform company? Looking at the most successful platforms, it becomes clear that becoming a platform does not happen overnight. You can’t simply build a platform, it needs to be grown, to be nurtured, with carefully orchestrated interactions. Most important is understanding how value is created on the platform and how different players derive value from it. Additionally, becoming a platform requires a bank to rethink the foundations on which it was built.

Banks are typically very proficient at calculating risk. But because of the multi-sided nature of a platform, you cannot control everything that happens on a platform. This requires an entirely different way of thinking about risk. Moreover, in order to stay ahead, experimentation and quick decision making are of vital importance. Unfortunately this often competes with a bank’s risk aversion. Finally, a platform business requires making money differently and you need to be able to scale. All challenging questions to answer for a traditional bank. But if you can get it right, you’re not easy to beat.

My role

Strategic designer

My responsibility in this project was moving from the future vision towards a concrete product. In the beginning my role was a lot about reframing questions and scoping our challenge. Later, when we started gathering a lot of internal and external data, I helped to structure all this information to insights and opportunity areas. Next, my responsibility moved to designing, prototyping and testing solutions. Finally, I helped crafting a narrative that tied our final product to the platform vision.

What we delivered

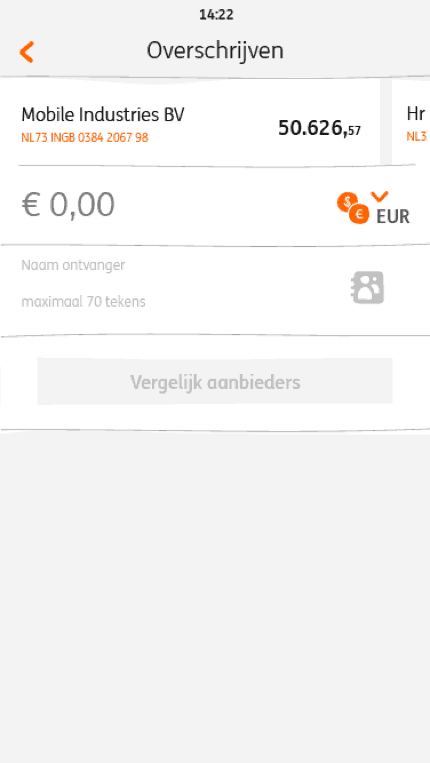

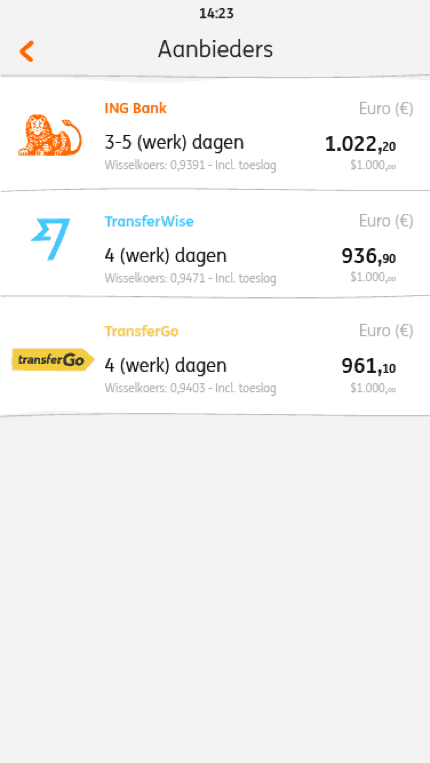

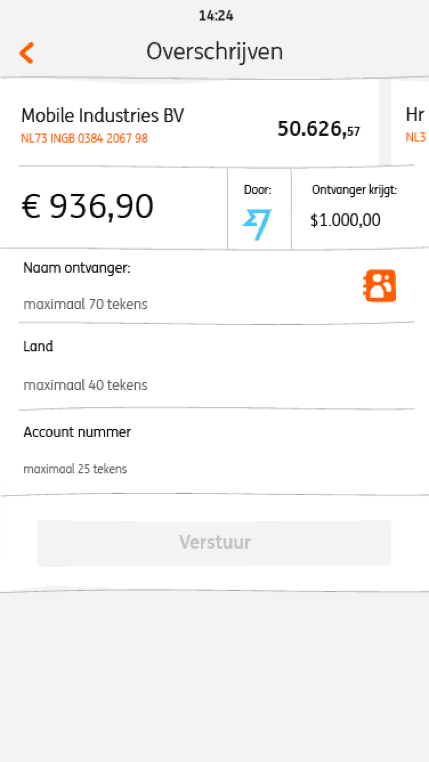

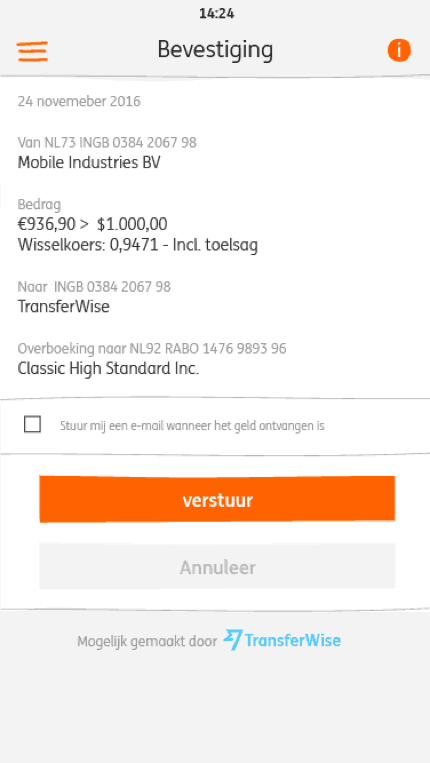

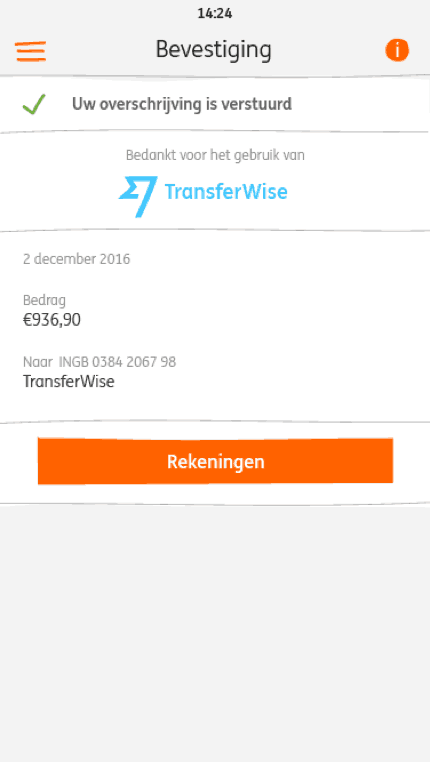

The outcome of this project was most concretely a mock-up app as shown below. This mock-up was a representation of the smallest, most viable, first step towards the big platform vision. Within the topic of international money transfer, it envisions how ING should partner with existing fintechs to increase the value of its own banking ecosystem. The mock-up was tested with existing clients which helped us gather the client’s perspective on ING’s platform vision.

Next to this tangible result, we layed out a platform vision for ING. We presented this vision to management and various stakeholders within the bank. As a result of this project, an MOU was signed with a succesfull fintech company to start making the platform reality.